- TRENDING

- Lok Sabha Elections

- MP Board Result

- Mera Power Vote

- MP Board Result 2024

- IPL 2024

- TSBIE Results

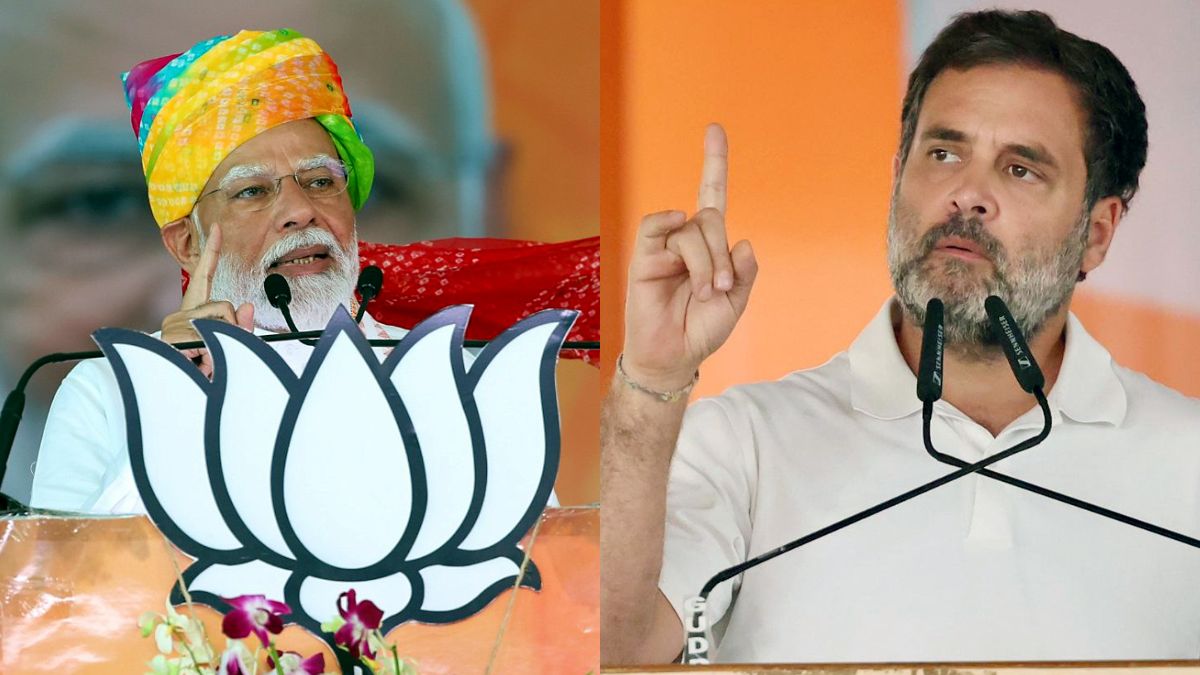

- PM Modi

- Ott Releases

- BTS

VideosView more

- 44 minutes agoLifestyle

5 Places To Visit This Summer Season In Himachal Pradesh With Your Pals

- 1 hour agoLifestyle

What Is PGAD, Medical Condition That Left US Woman With Permanent Arousal?

- 2 hours agoLifestyle

From Awareness to Action: Strategies for Malaria Prevention and Control

- 3 hours agoLifestyle

6 Key Reasons To Add Yogurt To Your Diet For Clean Skin And Healthy Hair

- 5 minutes agoEntertainment

BLACKPINK Jisoo To Join Red Velvet Seulgi’s Vlog; Know About The Kpop Idols’ Cherished Friendship

- 30 minutes agoEntertainment

Upcoming Telugu OTT Movies On Netflix, Prime Video, Disney+ Hotstar, JioCinema And More

- 45 minutes agoEntertainment

Diljit Dosanjh Net Worth | 5 Luxurious Assets Owned By The Punjabi Singer And Actor

- 1 hour agoEntertainment

Heeramandi FIRST Review Out: 'Mesmerised, This Is Truly Special Sanjay Leela Bhansali...'

- 2 hours agoEntertainment

Actress Megha Kaur Ventures Into Digital Realm With Upcoming Web Series Lockdown 2.0

- 56 minutes agoEducation

Karnataka 2nd PUC Exam 2 Admit Card Released At kseab.karnataka.gov.in; Exam On April 29