- TRENDING

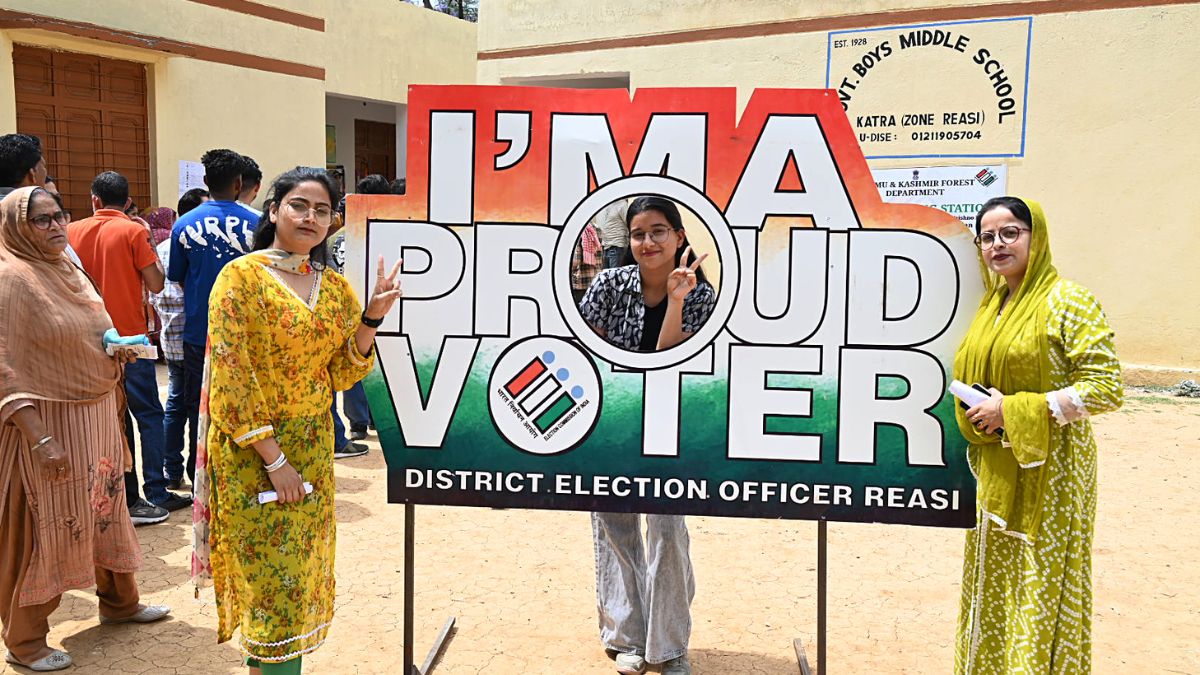

- Lok Sabha Elections

- Mera Power Vote

- Nagaland Board Result

- IPL 2024

- Live Election News

- PM Modi

- Ott Releases

- BTS

- CBSE Result

- 8 hours agoLifestyle

Keep In Mind These Expert-Recommended Do's And Don'ts To Manage Sports Injuries

- 9 hours agoLifestyle

- 30 minutes agoEntertainment

Top 5 Highest-Paid Kdrama Actresses: Lee Young Ae, Lee Ji Eun, Song Hye Kyo And Others

- 1 hour agoEntertainment

Samantha Ruth Prabhu Finds Work As Mental Health Advocate Difficult: 'Not Really Easy...'

- 2 hours agoEntertainment

Parineeti Chopra Opens Up On Bollywood Nepotism And Favouritism; Says 'Priyanka And I...'

- 6 hours agoEntertainment

BLACKPINK Jennie And Zico's Spot Song Out; Lisa, Jisoo And Rose Send Love | Watch