- TRENDING

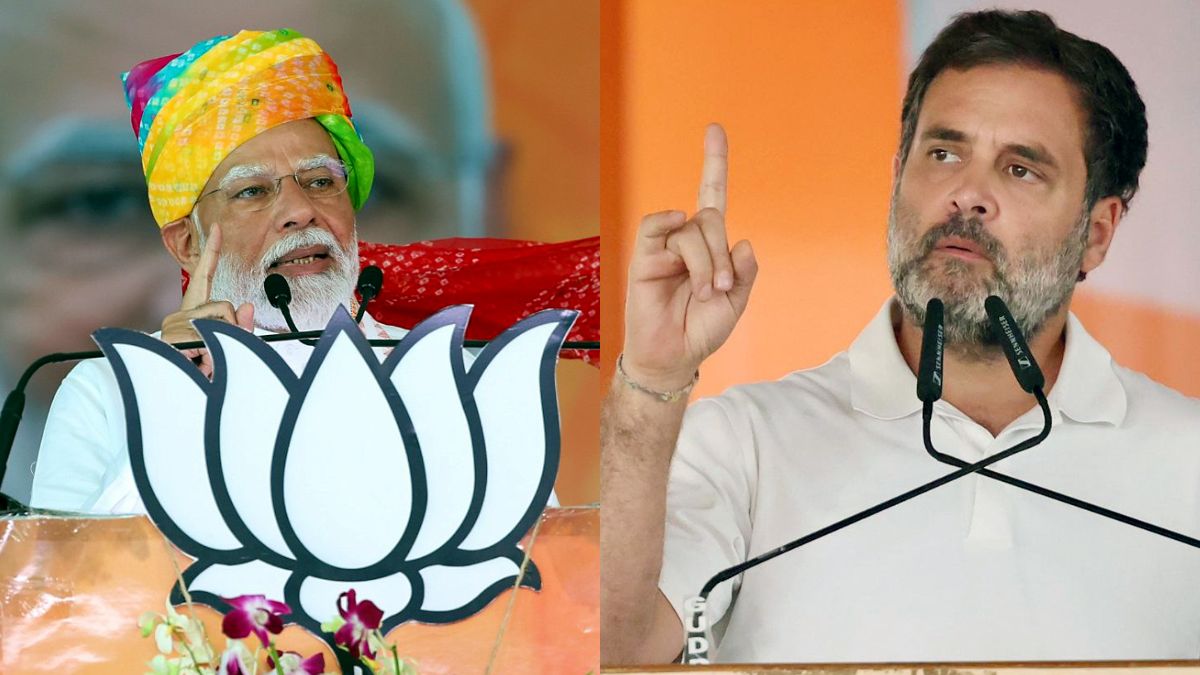

- Lok Sabha Elections

- MP Board Result

- Mera Power Vote

- MP Board Result 2024

- IPL 2024

- TSBIE Results

- PM Modi

- Ott Releases

- BTS

VideosView more

- 2 hours agoLifestyle

What Are The Immediate Symptoms Of Malaria; Know From Expert

- 8 minutes agoEntertainment

- 11 minutes agoEntertainment

Keerthy Suresh's Sultry Look From Varun Dhawan-Starrer Leaked Online | Watch

- 2 hours agoEntertainment

Is Konkana Sen Sharma Dating Amol Parashar? Ex-husband Ranvir Shorey's Comment Confirms THIS

- 2 hours agoEntertainment

Upcoming Telugu OTT Movies On Netflix, Prime Video, Disney+ Hotstar, JioCinema And More

- 4 minutes agoEducation

Tripura Schools Closed Till This Date Due To Heatwave; Check Details

- 1 hour agoEducation

Kerala SET July 2024 Registration Date Extended; Check Exam Pattern Here

- 34 minutes agoTechnology

Windows 11 Update Brings Ads In Start Menu; Check How To Turn It Off

- 2 hours agoTechnology

Apple Finally Brings Open Source AI Model Which Run On iPhones And PCs; Details