- TRENDING

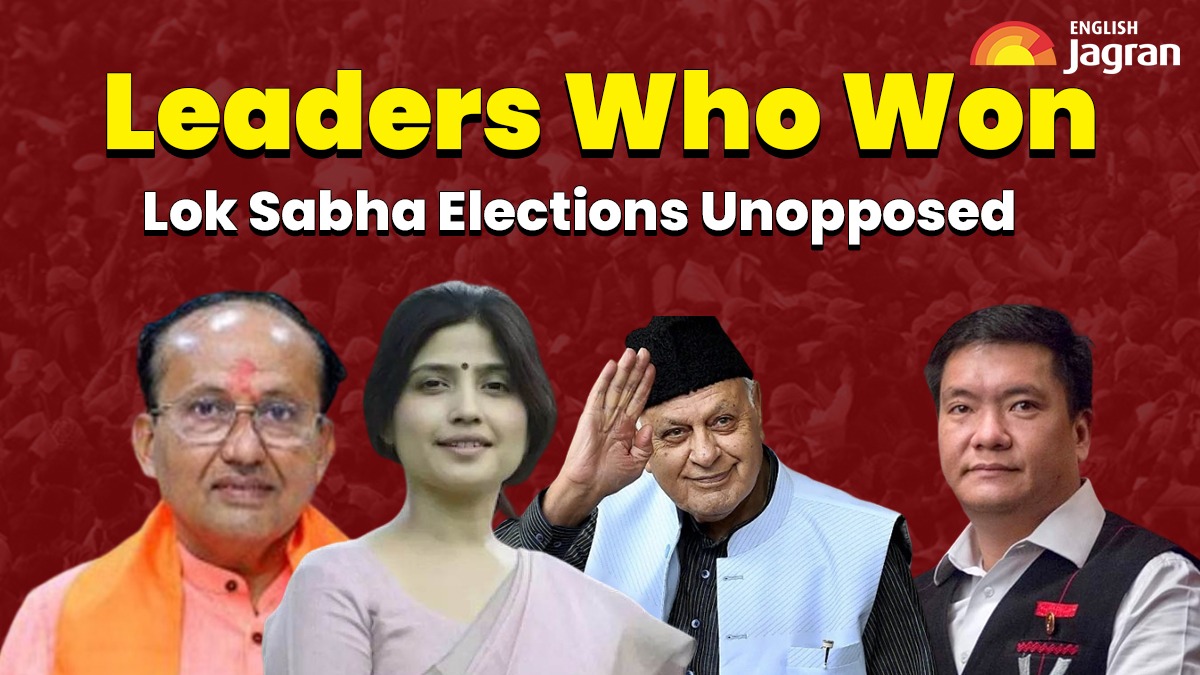

- Lok Sabha Elections

- Mera Power Vote

- MP 5th 8th result

- IPL 2024

- PM Modi

- Ott Releases

- BTS

- Hanuman Jayanti

- 9 minutes agoEntertainment

BTS Kdrama Youth: Sneak Peeks, Trailer And All Insights From The Star Cast

- 3 hours agoEntertainment

Throwback: When BTS Members Spoke Hindi On Indian Television And Sent Love To Desi ARMY

- 3 hours agoEntertainment

Heeramandi Star Manisha Koirala Opens Up On Not Working With Madhuri Dixit: ‘I Was Scared…’

- 35 minutes agoBusiness

Razorpay Launches 'UPI Switch' In Partnership With Airtel Payments Bank; Details

- 2 hours agoTechnology

Lava Prowatch VN, ZN Launched In India; Check Price, Specifications Here