- TRENDING

- Lok Sabha Elections

- Mera Power Vote

- IPL 2024

- UP Board Result

- Assam HSLC Result

- UPMSP Result

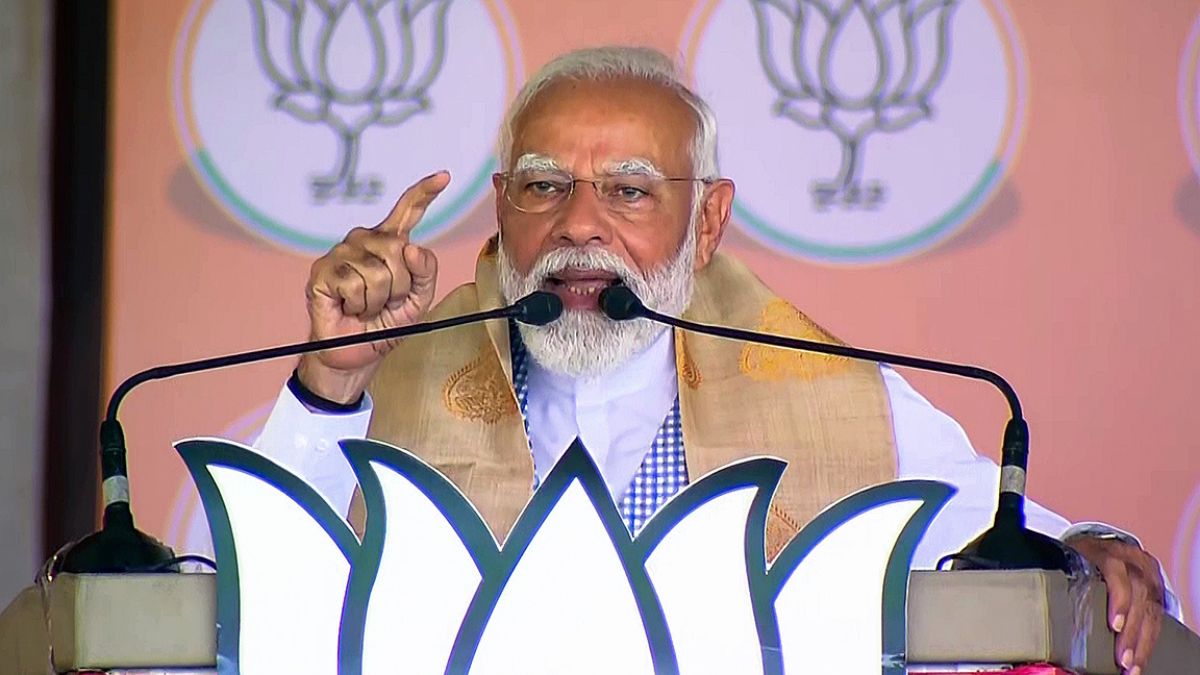

- PM Modi

- Ott Releases

- BTS

- 53 minutes agoLifestyle

Best Houseplants To Keep Your Home Cool And Fresh In Summers

- 13 minutes agoEntertainment

Ajay Devgn-Kajol Wish Nysa Devgan On Birthday With Unseen Photos, You can't Miss Her Childhood Pic

- 50 minutes agoEntertainment

- 2 hours agoEntertainment

Anchakkallakokkan On OTT: When And Where To Watch Malayalam Crime Thriller, Plot, Subscription

- 3 hours agoEntertainment

Manjummel Boys OTT Release Date OUT: Malayalam Film To Land On Netflix, Prime Video Or Hotstar?

- 4 hours agoEntertainment

Salman Khan's Bigg Boss OTT 3 Cancelled Amid Firing Incident? Makers Delete Announcement Post