- TRENDING

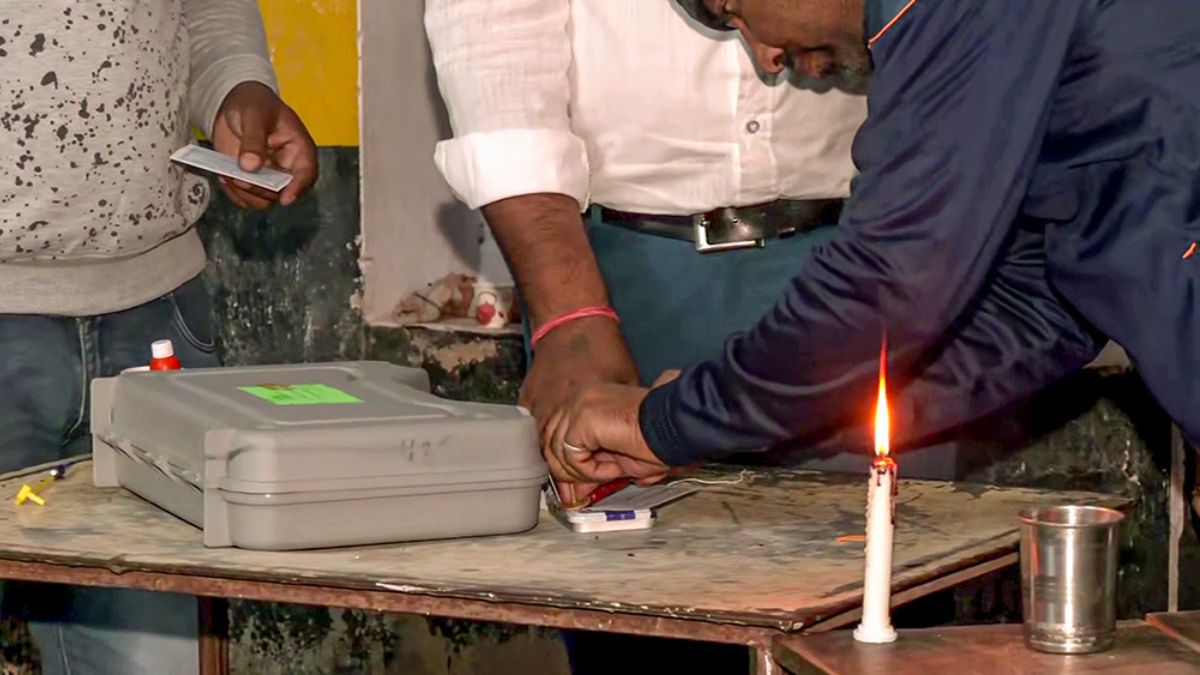

- Lok Sabha Elections

- Mera Power Vote

- Nagaland Board Result

- IPL 2024

- Live Election News

- PM Modi

- Ott Releases

- BTS

- CBSE Result

- 38 minutes agoLifestyle

Samantha Ruth Prabhu Is A Fashion Goddess In These Breathtaking Avatars | See Photos

- 48 minutes agoLifestyle

5 Cooling Face Masks To Beat Scorching Heat And Get Instant Radiant Glow

- 1 hour agoLifestyle

- 26 minutes agoEntertainment

- 3 hours agoEntertainment

Laapataa Ladies OTT Release: When And Where To Watch Kiran Rao's Content-Rich Movie Online?

- 2 minutes agoEducation

NEET UG 2024 Application Correction Window Closes Today; Here's How To Make Changes

- 18 hours agoWorld

Harvey Weinstein's 2020 Rape Conviction Overturned By New York Court

- 54 minutes agoTechnology

Lava Prowatch ZN And Prowatch VN Sale Starts Today: Check Specs, Special Prices Here