- TRENDING

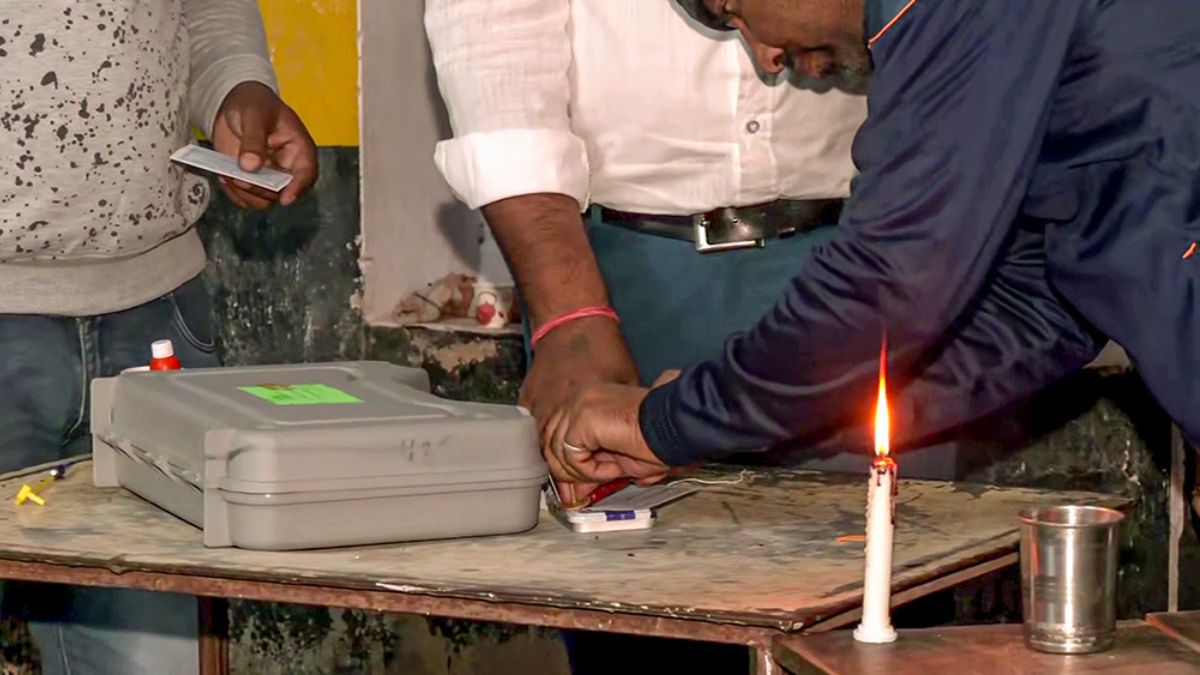

- Lok Sabha Elections

- Mera Power Vote

- Nagaland Board Result

- IPL 2024

- Live Election News

- PM Modi

- Ott Releases

- BTS

- CBSE Result

- 13 minutes agoLifestyle

- 1 hour agoLifestyle

6 Body Oil Massages And Their Amazing Benefits For Good Health

- 2 hours agoLifestyle

- 16 minutes agoEntertainment

Oru Nodi Twitter Review: Taman Kumar's Tamil Movie Receives A Thumbs Up From Netizens | Check Tweets

- 2 hours agoEntertainment

Laapataa Ladies OTT Release: When And Where To Watch Kiran Rao's Content-Rich Movie Online?

- 5 minutes agoEducation

NBSE HSLC, HSSLC Result 2024 LIVE: Nagaland Result To Be Out At 2 PM At nbse.nic.in

- 17 hours agoWorld

Harvey Weinstein's 2020 Rape Conviction Overturned By New York Court