- TRENDING

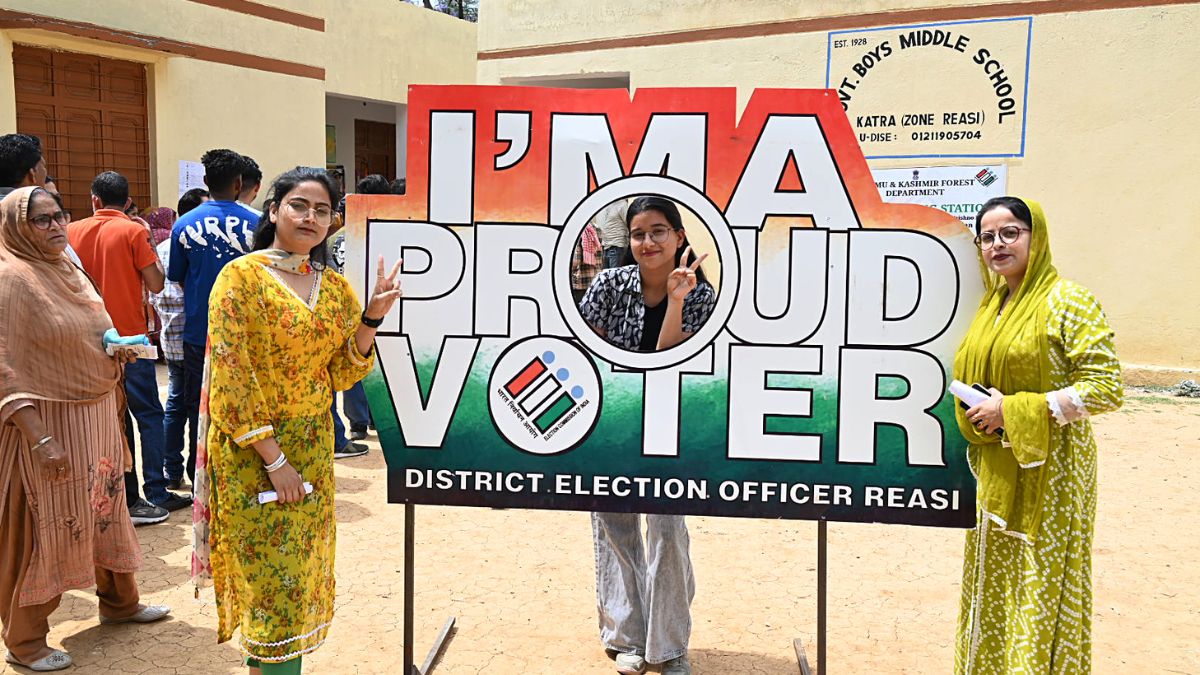

- Lok Sabha Elections

- Mera Power Vote

- Nagaland Board Result

- IPL 2024

- Live Election News

- PM Modi

- Ott Releases

- BTS

- CBSE Result

- 6 hours agoLifestyle

Keep In Mind These Expert-Recommended Do's And Don'ts To Manage Sports Injuries

- 8 hours agoLifestyle

- 8 minutes agoEntertainment

Samantha Ruth Prabhu Finds Work As Mental Health Advocate Difficult: 'Not Really Easy...'

- 46 minutes agoEntertainment

Parineeti Chopra Opens Up On Bollywood Nepotism And Favouritism; Says 'Priyanka And I...'

- 5 hours agoEntertainment

BLACKPINK Jennie And Zico's Spot Song Out; Lisa, Jisoo And Rose Send Love | Watch

- 7 hours agoEducation

CLAT 2025 Exams To Be Conducted In First Week Of December; Details Here

- 20 minutes agoWorld

King Charles To Resume Public Duties Next Week After Cancer Diagnosis

- 26 minutes agoIndia

Rahul Gandhi Takes 'Empty Pot' Jibe At PM Modi After Karnataka Rally

- 4 hours agoTechnology

Elon Musk’s AI Company ‘xAI’ To Raise $6 Billion, Claims Report