- TRENDING

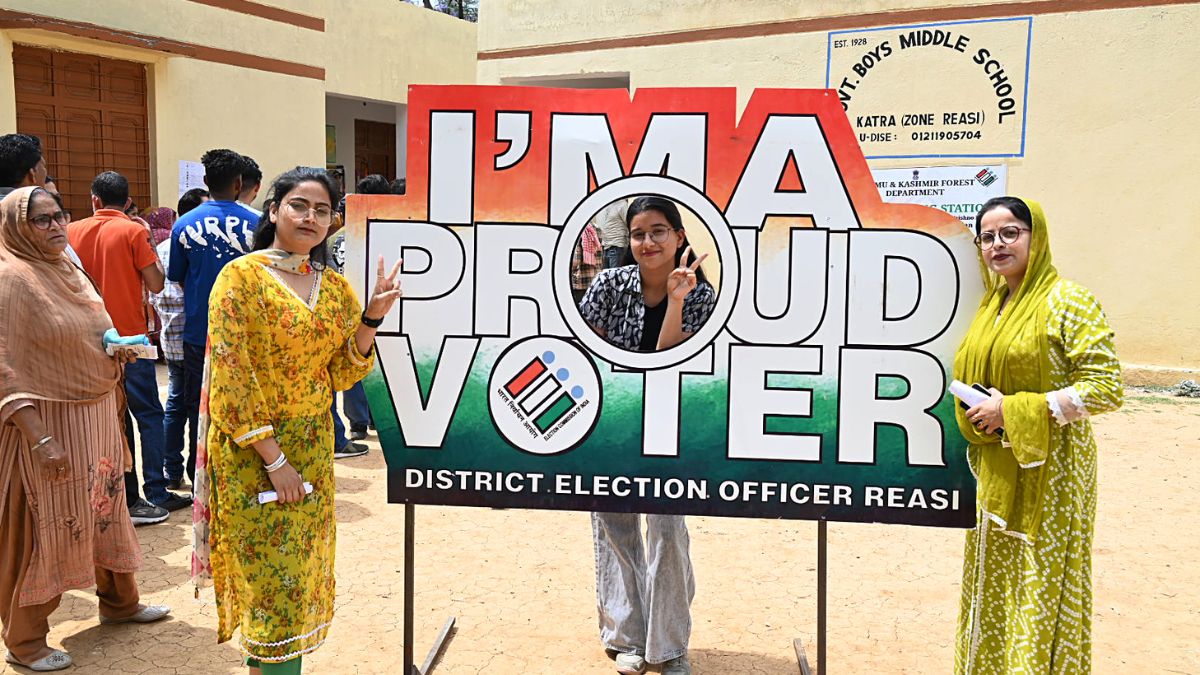

- Lok Sabha Elections

- Mera Power Vote

- Nagaland Board Result

- IPL 2024

- Live Election News

- PM Modi

- Ott Releases

- BTS

- CBSE Result

- 11 hours agoLifestyle

Keep In Mind These Expert-Recommended Do's And Don'ts To Manage Sports Injuries

- 12 hours agoLifestyle

- 4 hours agoEntertainment

Top 5 Highest-Paid Kdrama Actresses: Lee Young Ae, Lee Ji Eun, Song Hye Kyo And Others

- 5 hours agoEntertainment

Samantha Ruth Prabhu Finds Work As Mental Health Advocate Difficult: 'Not Really Easy...'

- 6 hours agoEntertainment

Parineeti Chopra Opens Up On Bollywood Nepotism And Favouritism; Says 'Priyanka And I...'