- TRENDING

- Lok Sabha Elections

- Mera Power Vote

- Nagaland Board Result

- IPL 2024

- Live Election News

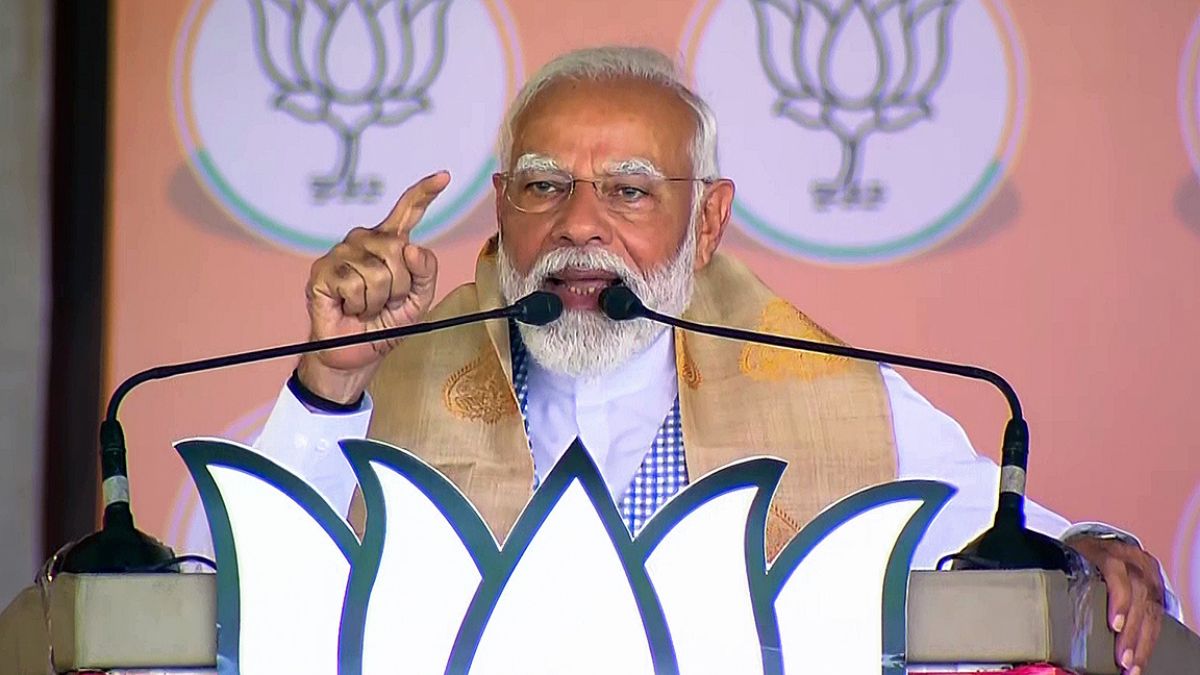

- PM Modi

- Ott Releases

- BTS

- CBSE Result

- 34 minutes agoLifestyle

- 47 minutes agoLifestyle

How To Keep Your Makeup Flawless Despite The Summer Sweat? Expert Weighs In

- 2 hours agoLifestyle

20 Powerful Quotes By BLACKPINK To Make You Feel Worthy And Special

- 17 minutes agoEntertainment

Pavi Caretaker Twitter Review: Check These Tweets Before Watching Dileep's Comedy Drama

- 27 minutes agoEntertainment

- 2 hours agoEntertainment

Rekha Kisses Richa Chadha's Baby Bump At Heeramandi Premiere, Watch Viral Video

- 34 minutes agoBusiness

Tech Mahindra Shares Rise Over 12% After Q4 Results; Company To Consider Dividend

- 3 hours agoTechnology

Lava Prowatch ZN And Prowatch VN Sale Starts Today: Check Specs, Special Prices Here