- TRENDING

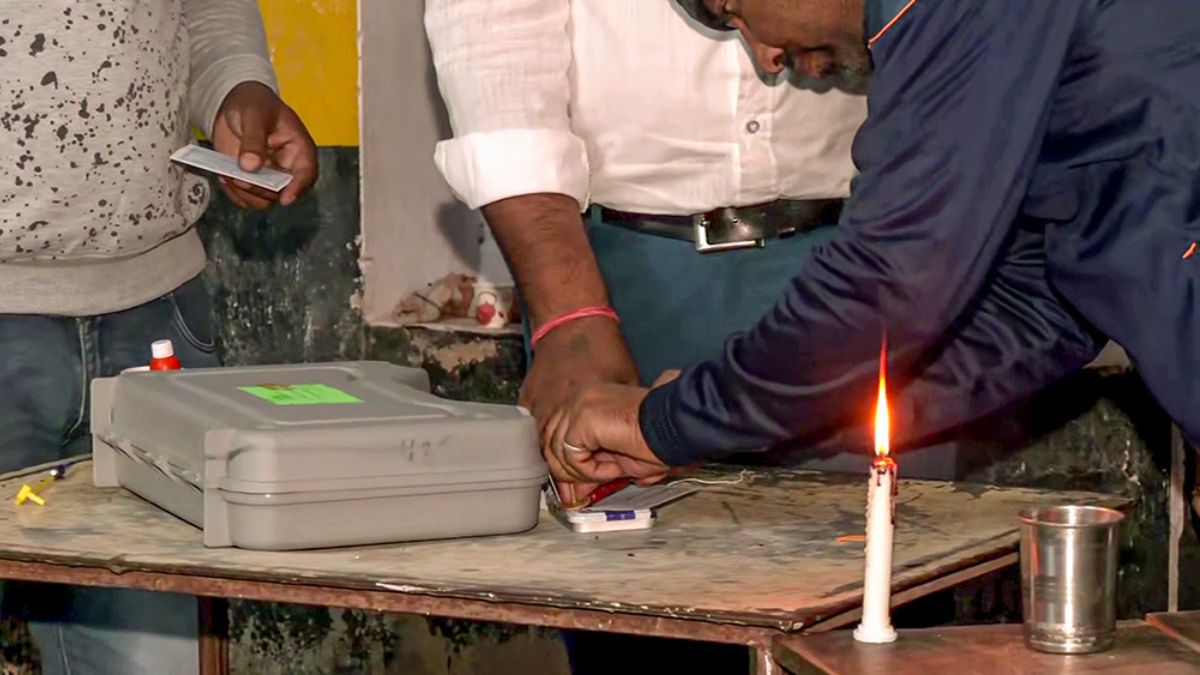

- Lok Sabha Elections

- Mera Power Vote

- Nagaland Board Result

- IPL 2024

- Live Election News

- PM Modi

- Ott Releases

- BTS

- CBSE Result

- 11 minutes agoLifestyle

6 Body Oil Massages And Their Amazing Benefits For Good Health

- 39 minutes agoLifestyle

- 1 hour agoLifestyle

- 41 minutes agoEntertainment

Laapataa Ladies OTT Release: When And Where To Watch Kiran Rao's Content-Rich Movie Online?

- 47 minutes agoEntertainment

- 51 minutes agoEntertainment

Medha Shankr Compares Success Of 12th Fail With Gadar; Says ‘Big Filmmakers Have Faith In Me Now’

- 16 minutes agoEducation

NBSE HSLC, HSSLC Result 2024 LIVE: Nagaland Result To Be Out At 2 PM At nbse.nic.in

- 15 hours agoWorld

Harvey Weinstein's 2020 Rape Conviction Overturned By New York Court

- 16 minutes agoTechnology

Garena Free Fire MAX Redeem Codes Today, April 26, 2024: Get Freebies And Diamonds Here