- TRENDING

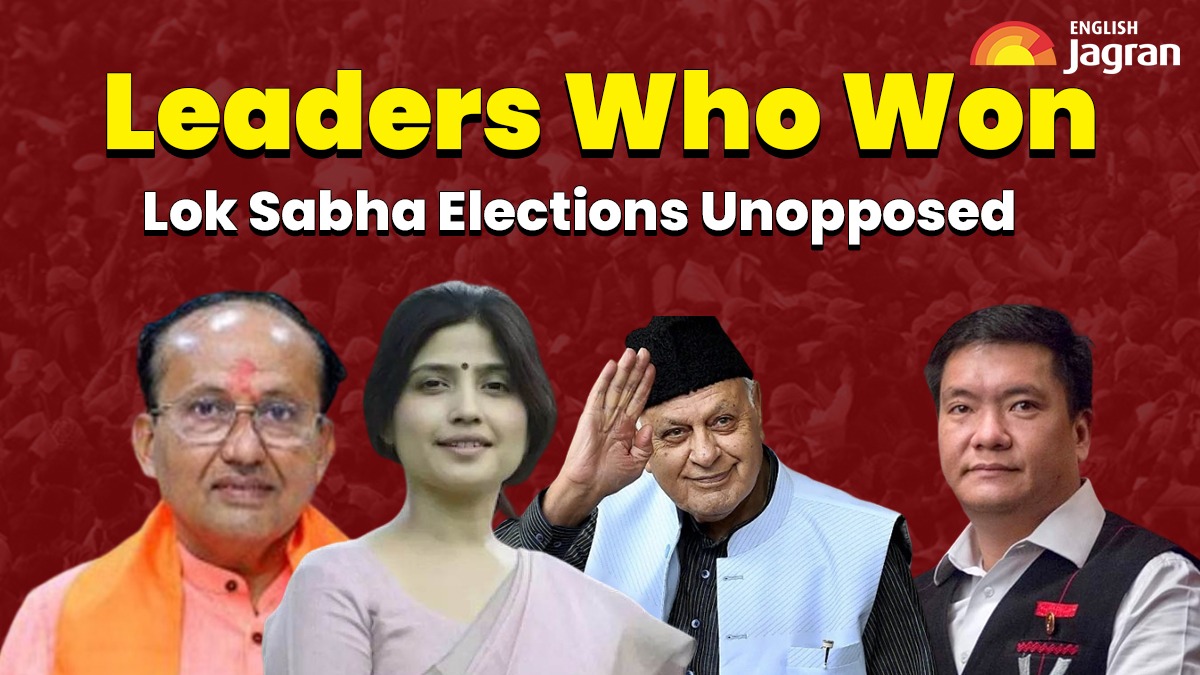

- Lok Sabha Elections

- Mera Power Vote

- MP 5th 8th result

- IPL 2024

- PM Modi

- Ott Releases

- BTS

- Hanuman Jayanti

- 40 minutes agoLifestyle

5 Times Shehnaaz Gill Raised The Bar With Her Bold Appearances | SEE PICTURES

- 45 minutes agoLifestyle

How To Be Happy In Life: Adopt These 5 Everyday Habits To Stay Happy And Positive

- 1 hour agoLifestyle

- 2 hours agoEntertainment

Throwback: When BTS Members Spoke Hindi On Indian Television And Sent Love To Desi ARMY

- 2 hours agoEntertainment

Heeramandi Star Manisha Koirala Opens Up On Not Working With Madhuri Dixit: ‘I Was Scared…’

- 3 hours agoEntertainment

Pushpa 2: First Song From Allu Arjun’s Highly-anticipated Movie To Be Out In THIS Month; Report