- TRENDING

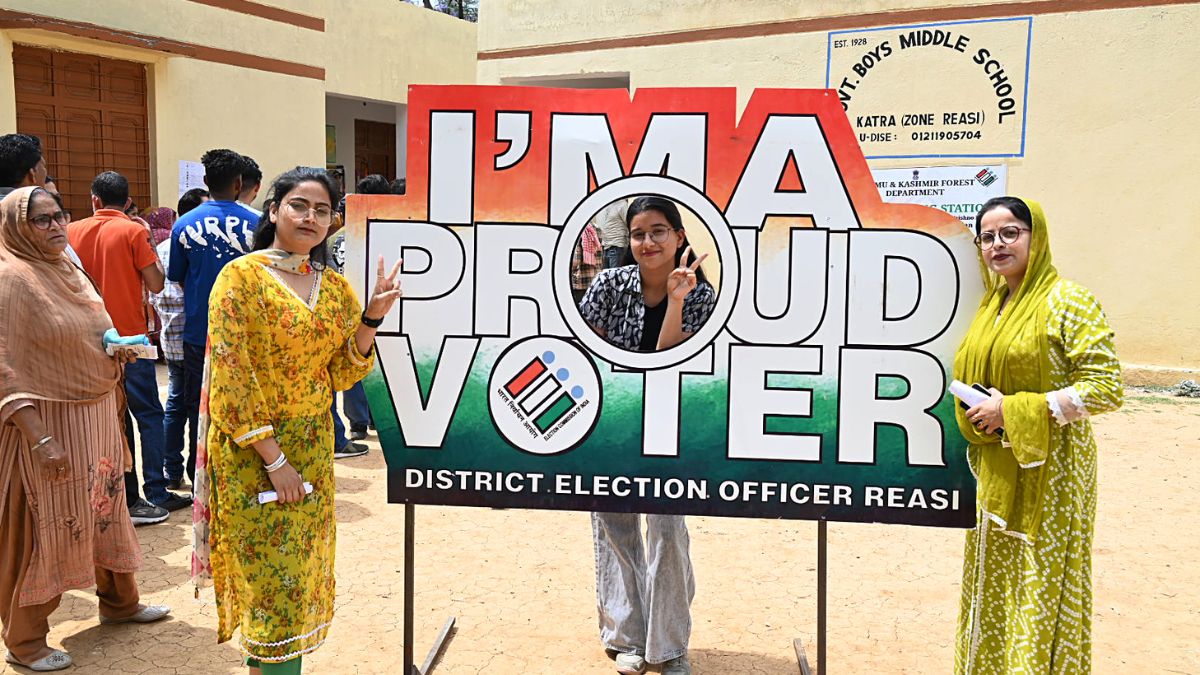

- Lok Sabha Elections

- Mera Power Vote

- Nagaland Board Result

- IPL 2024

- Live Election News

- PM Modi

- Ott Releases

- BTS

- CBSE Result

- 6 hours agoLifestyle

Keep In Mind These Expert-Recommended Do's And Don'ts To Manage Sports Injuries

- 7 hours agoLifestyle

- 4 hours agoEntertainment

BLACKPINK Jennie And Zico's Spot Song Out; Lisa, Jisoo And Rose Send Love | Watch

- 5 hours agoEntertainment

Arbaaz Khan Breaks Silence On Malaika Arora’s ‘Indecisive’ Statement; Says ‘Don’t Want To…’