- TRENDING

- Lok Sabha Elections

- MP Board Result

- Mera Power Vote

- MP Board Result 2024

- IPL 2024

- TSBIE Results

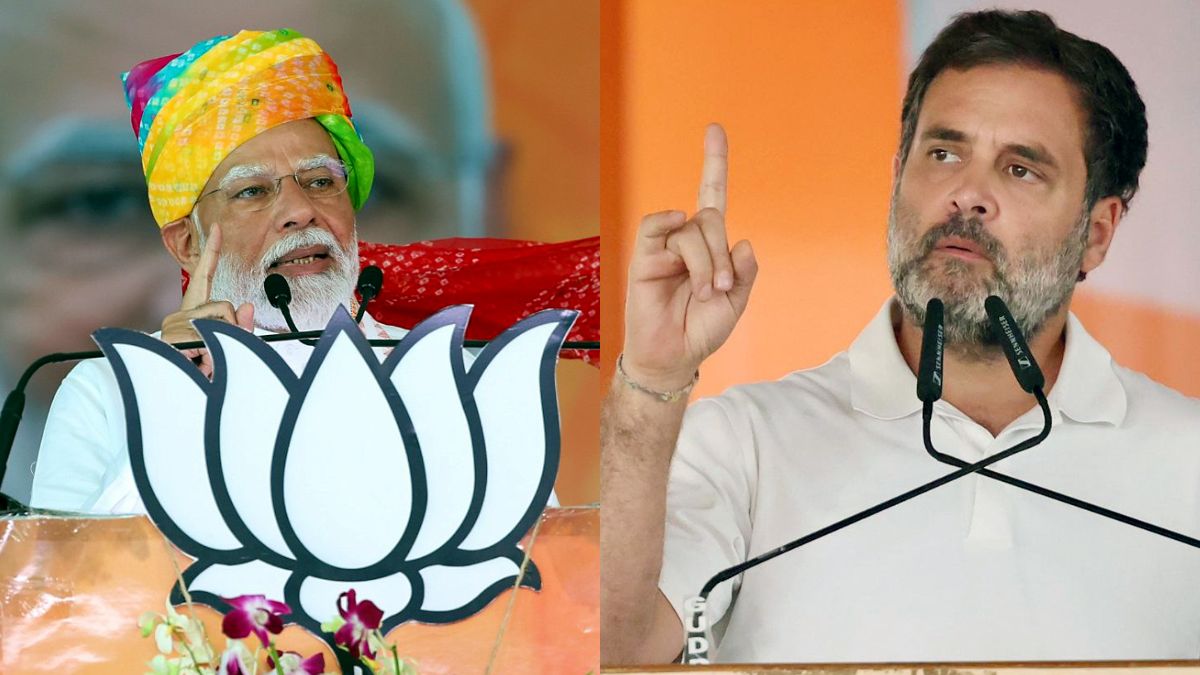

- PM Modi

- Ott Releases

- BTS

VideosView more

- 37 minutes agoLifestyle

Insights From A Doctor For Some Common Myths And Uncovering Facts About Malaria

- 1 hour agoLifestyle

What Are The Immediate Symptoms Of Malaria; Know From Expert

- 2 hours agoLifestyle

5 Places To Visit This Summer Season In Himachal Pradesh With Your Pals

- 3 hours agoLifestyle

What Is PGAD, Medical Condition That Left US Woman With Permanent Arousal?

- 49 minutes agoEntertainment

Is Konkana Sen Sharma Dating Amol Parashar? Ex-husband Ranvir Shorey's Comment Confirms THIS

- 53 minutes agoEntertainment

Upcoming Telugu OTT Movies On Netflix, Prime Video, Disney+ Hotstar, JioCinema And More

- 2 hours agoEntertainment

Diljit Dosanjh Net Worth | 5 Luxurious Assets Owned By The Punjabi Singer And Actor

- 56 minutes agoTechnology

Apple Finally Brings Open Source AI Model Which Run On iPhones And PCs; Details