- TRENDING

- Lok Sabha Elections

- Mera Power Vote

- Nagaland Board Result

- IPL 2024

- Live Election News

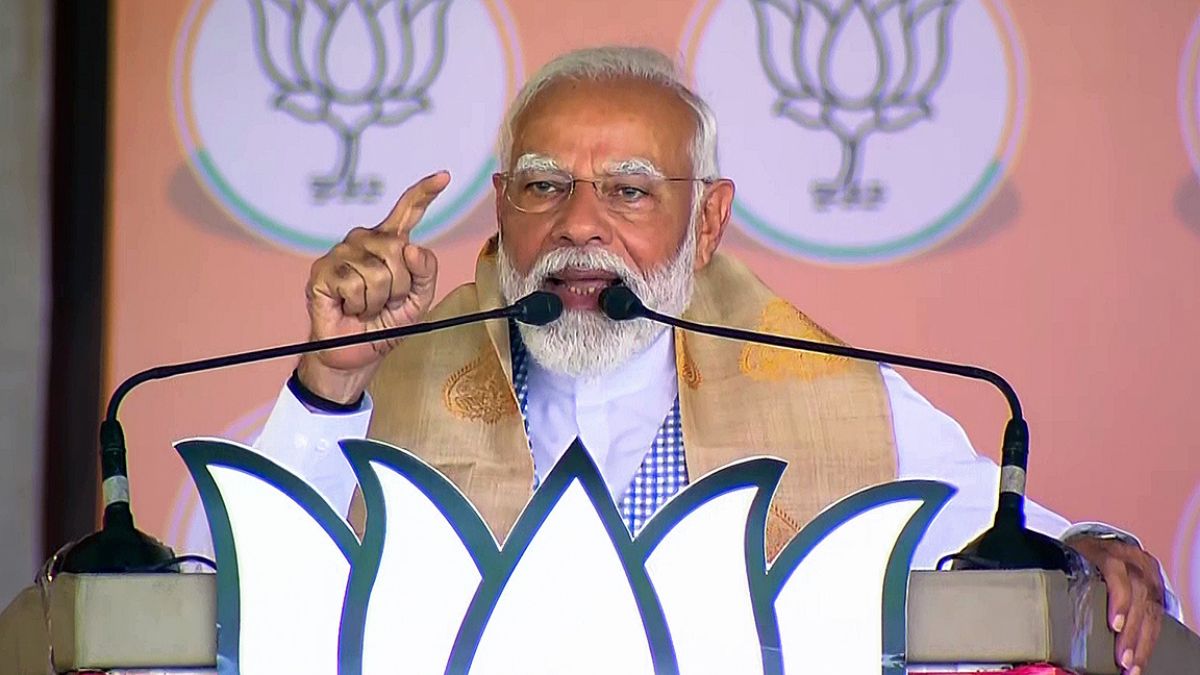

- PM Modi

- Ott Releases

- BTS

- CBSE Result

- 40 minutes agoLifestyle

- 51 minutes agoLifestyle

Can Mental Stress Cause Vision Problems? Doctor Explains How Stress Affects Your Eyes

- 2 hours agoLifestyle

- 2 hours agoLifestyle

How To Keep Your Makeup Flawless Despite The Summer Sweat? Expert Weighs In

- 8 minutes agoEntertainment

Kim Soo Hyun Net Worth: Is Queen Of Tears Actor Even Richer Than Fictional Queens Group?

- 17 minutes agoEntertainment

Aavesham On OTT: Release Date, Where To Watch Fahadh Faasil's Movie Online, Subscription And More

- 21 minutes agoEntertainment

Queen of Tears, Crash Landing On You To Squid Game: Popular KDramas To Watch On Netflix

- 1 hour agoEntertainment

Pavi Caretaker Twitter Review: Check These Tweets Before Watching Dileep's Comedy Drama

- 3 hours agoEntertainment

Rekha Kisses Richa Chadha's Baby Bump At Heeramandi Premiere, Watch Viral Video

- 38 minutes agoBusiness

Stock Market Closing: Sensex, Nifty Break 5 Days Winning Streak Amid Profit Booking

- 59 minutes agoTechnology

Google Meet Now Allow Users To Seamlessly Switch Devices During Their Calls; Here's How